Billing History

Access your complete subscription billing history, view past invoices, download receipts, and manage payment methods.

Overview

The Billing History page allows you to:

- View all past subscription invoices

- Download invoice copies and receipts

- Track payment history

- Update payment methods

- View billing cycle information

- Access tax documents

Accessing Billing History

- Navigate to Subscription → Billing from the main menu

- Or click on your profile and select Billing History

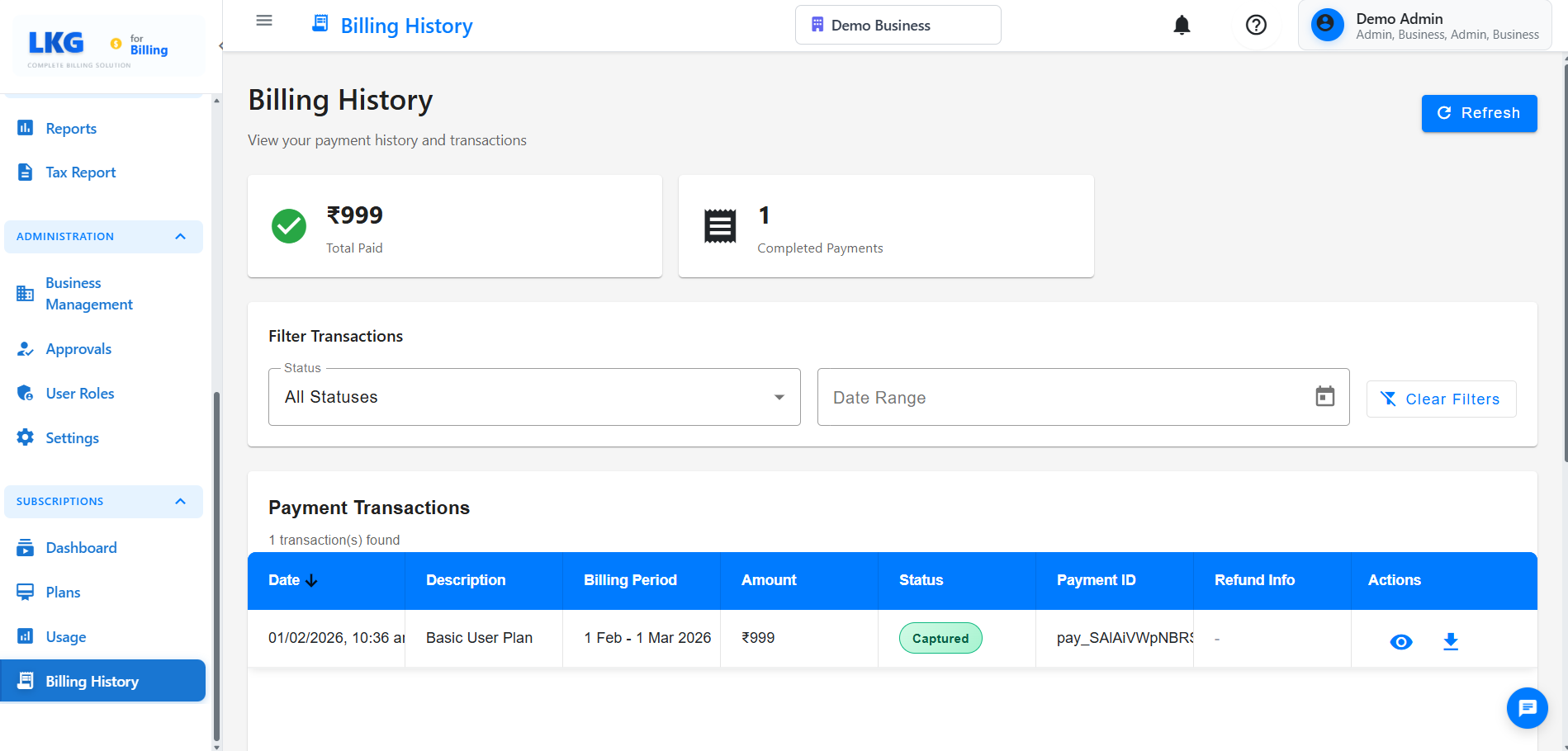

Invoice List

Invoice Information

Each invoice displays:

- Invoice Number: Unique identifier (e.g., INV-2025-001)

- Invoice Date: Date the invoice was generated

- Billing Period: Coverage period (e.g., Jan 1 - Jan 31, 2025)

- Plan: Subscription plan name (Starter, Professional, Enterprise)

- Amount: Total amount charged

- Status: Payment status (Paid, Pending, Failed)

- Actions: Download, View, Print options

Invoice Status

Paid ✅

- Payment successfully processed

- Receipt available for download

- Service active

Pending ⏳

- Payment processing

- Awaiting confirmation

- Service remains active temporarily

Failed ❌

- Payment unsuccessful

- Retry payment required

- Service may be suspended

Refunded 🔄

- Payment refunded

- Credit applied to account

- Adjustment invoice generated

Viewing Invoice Details

Invoice Breakdown

Click on any invoice to view:

Subscription Details

- Plan name and tier

- Billing cycle (Monthly/Yearly)

- Subscription period

- Pro-rated charges (if applicable)

Charges

- Base subscription fee

- Add-on charges

- Discounts applied

- Taxes (GST/IGST)

- Total amount

Payment Information

- Payment method used

- Transaction ID

- Payment date and time

- Payment gateway reference

Downloading Invoices

Download Options

-

PDF Format

- Click Download PDF button

- Professional invoice format

- Includes company details and tax information

- Suitable for accounting records

-

Print Invoice

- Click Print button

- Printer-friendly format

- Optimized layout

- Include payment receipt

Bulk Download

Download multiple invoices:

- Select invoices using checkboxes

- Click Download Selected

- Choose format (PDF or ZIP)

- Download combined file

Payment Methods

Current Payment Method

View your active payment method:

- Card type and last 4 digits

- Expiry date

- Billing address

- Default payment indicator

Adding a Payment Method

- Click Add Payment Method

- Enter card details or select UPI/Net Banking

- Verify with OTP (if required)

- Save for future payments

Updating Payment Method

- Click Update Payment Method

- Enter new payment details

- Verify the change

- Set as default (optional)

Removing a Payment Method

- Click Remove next to the payment method

- Confirm removal

- Ensure another payment method is set as default

You must have at least one active payment method for automatic renewals.

Payment History

Transaction Log

View all payment transactions:

| Date | Invoice | Amount | Method | Status | Receipt |

|---|---|---|---|---|---|

| Jan 15, 2025 | INV-2025-001 | ₹999 | Visa •••• 1234 | Success | Download |

| Dec 15, 2024 | INV-2024-012 | ₹999 | Visa •••• 1234 | Success | Download |

| Nov 15, 2024 | INV-2024-011 | ₹999 | UPI | Success | Download |

Failed Payments

If a payment fails:

- You'll receive an email notification

- Retry payment within 7 days

- Update payment method if needed

- Contact support if issues persist

Retry Payment:

- Click Retry Payment on the failed invoice

- Confirm payment method

- Complete the transaction

Billing Cycle Information

Current Billing Cycle

View your active billing period:

- Start Date: Beginning of current cycle

- End Date: Renewal date

- Days Remaining: Time until next billing

- Next Invoice Date: When you'll be charged next

- Next Amount: Expected charge amount

Renewal Settings

Auto-Renewal (Recommended)

- Automatic payment on renewal date

- No service interruption

- Email reminder 7 days before renewal

Manual Renewal

- Requires manual payment

- Risk of service suspension

- Payment reminder emails sent

Enable auto-renewal to ensure uninterrupted service and avoid late fees.

Tax Documents

GST Invoices

For Indian customers:

- All invoices include GST breakdown

- CGST + SGST for intra-state

- IGST for inter-state

- GSTIN displayed on invoice

Tax Certificates

Download annual tax summary:

- Navigate to Tax Documents

- Select financial year

- Download consolidated statement

- Use for tax filing purposes

Refunds and Credits

Refund Status

Track refund requests:

- Refund amount

- Reason for refund

- Processing status

- Expected credit date

- Refund method

Account Credits

View available credits:

- Credit amount

- Source (refund, promotion, adjustment)

- Expiry date (if applicable)

- Applied to next invoice automatically

Frequently Asked Questions

How long are invoices stored?

All invoices are stored indefinitely and available for download anytime.

Can I get a duplicate invoice?

Yes, simply download the invoice again from your billing history.

What if my payment fails?

You'll have 7 days to retry the payment. Update your payment method if needed.

Can I change my billing cycle?

Yes, contact support to switch between monthly and yearly billing.

How do I get a refund?

Contact support within 7 days of payment with your refund request.

Are invoices GST compliant?

Yes, all invoices include proper GST breakdown and are compliant with Indian tax laws.

- Subscription Plans - View and change your plan

- Usage Monitoring - Track your consumption

- Account Settings - Manage your preferences