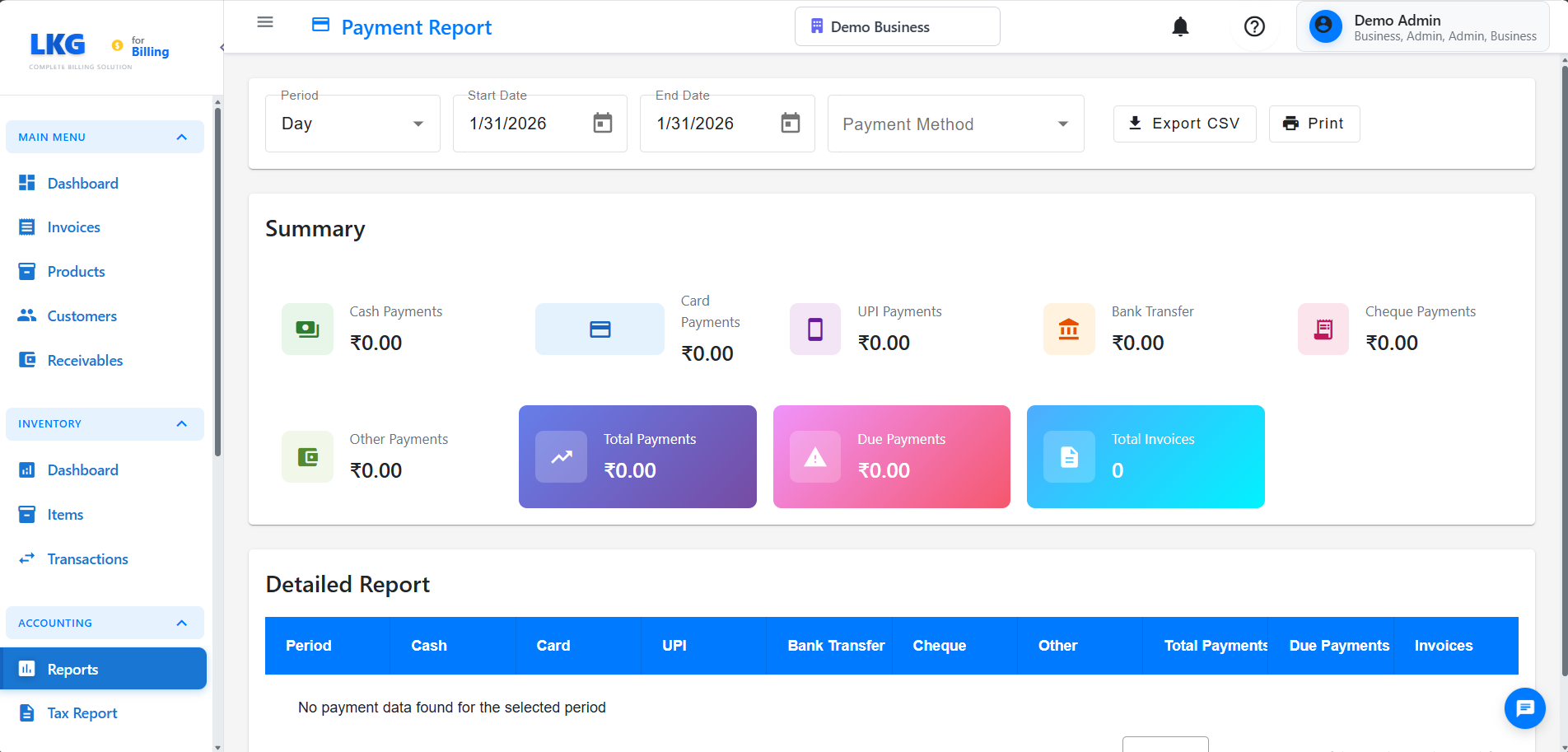

Payment Report

The Payment Report provides detailed insights into payment collections across different payment methods, helping you track cash flow, reconcile accounts, and understand customer payment preferences.

Overview

The Payment Report displays:

- Payments by method (Cash, Card, UPI, Bank Transfer, Cheque, Other)

- Total payments received

- Outstanding due amounts

- Invoice counts

- Daily, monthly, or custom period analysis

Accessing the Report

- Navigate to Accounting → Reports

- Click on Payment Report

- Select report period type

- Choose date range if custom period

- Click Generate Report

Report Period Options

Day

- View payment data for a single day

- Useful for daily cash reconciliation

- Quick end-of-day settlement review

Month

- View payment data for an entire month

- Month-to-date analysis

- Monthly financial closing

Custom

- Select any date range

- Quarter or year-end reviews

- Flexible analysis periods

Report Columns

Date

The date or period for which payments are displayed

Cash Payments

Total amount received in cash

- Physical currency payments

- Most common for walk-in customers

- Requires manual counting and reconciliation

Card Payments

Total amount received via credit/debit cards

- Includes all card transactions

- Usually processed through payment gateway

- Subject to processing fees

UPI Payments

Total amount received via UPI (Unified Payments Interface)

- Digital payments through apps like GPay, PhonePe, Paytm

- Instant settlement

- Popular in India

Bank Transfer Payments

Total amount received via direct bank transfers

- NEFT, RTGS, IMPS transfers

- Usually for larger transactions

- Requires bank statement reconciliation

Cheque Payments

Total amount received via cheques

- Physical cheque payments

- Requires bank clearance

- May take 2-3 days to clear

Other Payments

Payments through other methods

- Gift cards, vouchers

- Credit notes

- Any custom payment methods

Total Payments

Sum of all payment methods for the period

- Complete payment collection

- Compare against invoice totals

Due Payments

Outstanding amounts yet to be collected

- Unpaid invoices

- Partially paid invoices

- Overdue amounts

Invoice Count

Number of invoices associated with payments in the period

Summary Section

At the top of the report, view aggregate totals:

- Total Cash: Sum of all cash payments

- Total Card: Sum of all card payments

- Total UPI: Sum of all UPI payments

- Total Bank Transfer: Sum of all bank transfer payments

- Total Cheque: Sum of all cheque payments

- Total Other: Sum of all other payments

- Grand Total: Combined total of all payments

- Total Due: Total outstanding amount

- Total Invoices: Total number of invoices

Common Use Cases

Daily Cash Reconciliation

- Select Day period type

- Choose today's date

- Generate report

- Compare cash payment total with physical cash counted

- Identify and resolve discrepancies

Payment Method Analysis

- Run report for a month or quarter

- Compare payment method totals

- Identify preferred customer payment methods

- Optimize payment options based on usage

Collection Efficiency

- Compare Total Payments vs. Total Due

- Calculate collection rate

- Identify overdue invoices

- Follow up on outstanding payments

Bank Reconciliation

- Generate report for the month

- Export card, UPI, and bank transfer data

- Match with bank statements

- Identify missing or duplicate transactions

Monthly Financial Closing

- Set period to previous month

- Verify all payments are recorded

- Check due amounts

- Generate report for accounting records

Exporting Data

Export payment reports in multiple formats:

- Excel (.xlsx): Detailed data with formulas for analysis

- PDF: Professional format for presentations and printing

- CSV: Raw data for importing into accounting software

Best Practices

✅ Do:

- Run daily reports for cash reconciliation

- Reconcile card/UPI payments with bank statements monthly

- Follow up on due payments promptly

- Keep exported reports for audit trail

- Verify payment method totals match invoice records

❌ Don't:

- Skip daily cash reconciliation

- Ignore discrepancies between report and bank statements

- Forget to account for processing fees in card payments

- Mix payment data from different businesses

- Rely solely on reports without physical verification

Understanding Payment Status

Paid Invoices

Invoices where payment received equals the invoice total

Partially Paid Invoices

Invoices where some payment has been received but amount due remains

Unpaid Invoices

Invoices with no payments received (shown in Due Payments column)

Reconciliation Tips

For Cash Payments

- Count physical cash at end of day

- Compare with Cash Payments in report

- Account for cash expenses if any

- Investigate any differences

For Card/UPI Payments

- Download bank/payment gateway statement

- Match individual transactions

- Account for processing fees

- Verify settlement dates

For Cheque Payments

- List all cheques received

- Check clearance status with bank

- Update invoice status after clearance

- Follow up on bounced cheques

Troubleshooting

Payment Totals Don't Match

Problem: Report totals don't match expected amounts

Solution:

- Verify correct date range selected

- Check if all invoices are in the correct business

- Look for partially paid invoices

- Ensure payment methods are correctly categorized

Missing Payments

Problem: Known payments not showing in report

Solution:

- Confirm payment was recorded in the system

- Verify payment date falls within report period

- Check if invoice was marked as paid

- Look for payment in other businesses (if multi-business user)

Due Payments Seem Wrong

Problem: Due payments amount is unexpected

Solution:

- Review unpaid invoices list

- Check for partial payments

- Verify invoice statuses

- Look for overdue invoices