GST Report

The GST Report provides comprehensive insights into your Goods and Services Tax (GST) transactions, helping you track tax collections, file returns accurately, and maintain compliance with tax regulations.

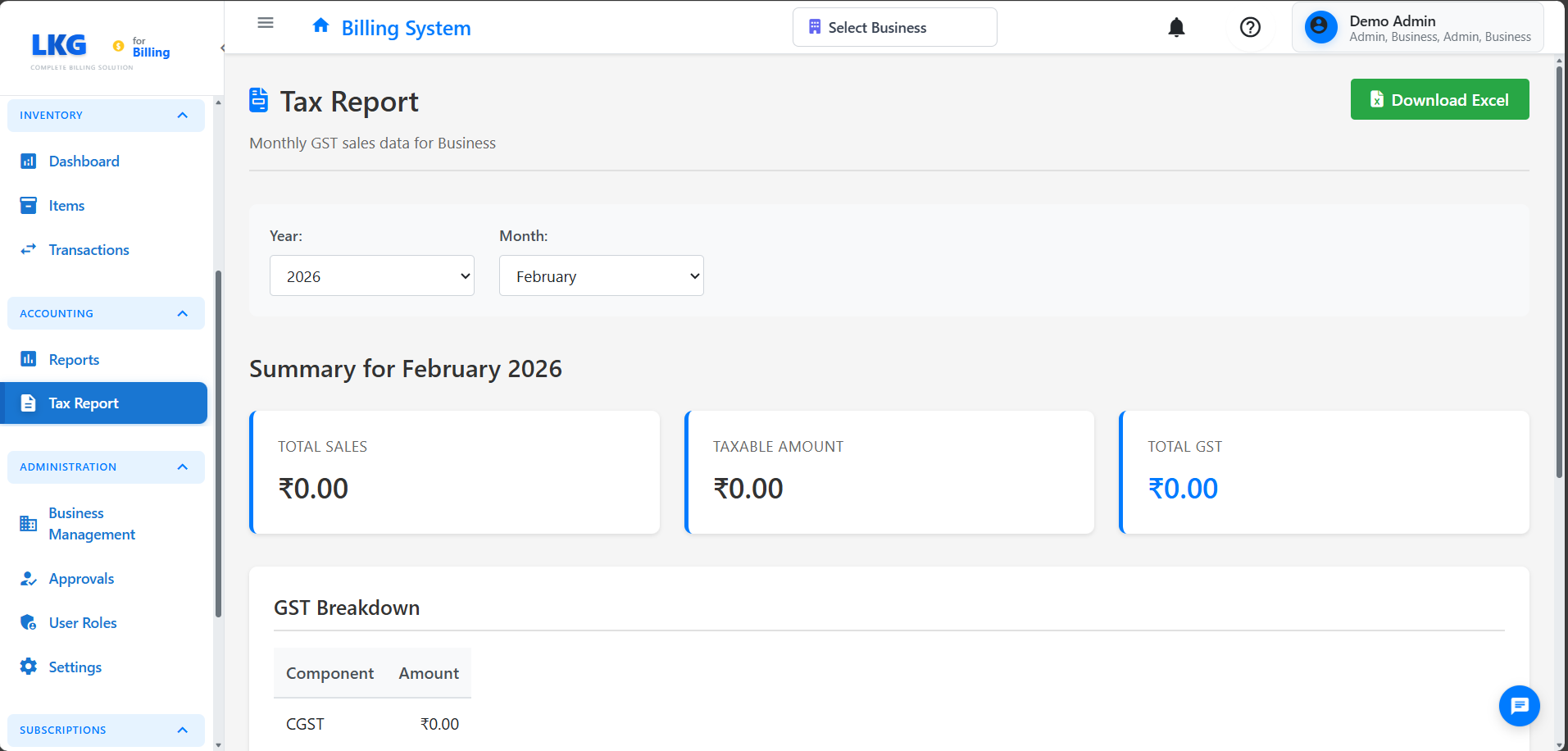

Overview

The GST Report displays:

- GST collected by tax rate (CGST, SGST, IGST)

- Taxable amount breakdowns

- Tax liability calculations

- Invoice-wise GST details

- Period-wise tax summaries

- Input tax credit (ITC) eligible amounts

Accessing the Report

- Navigate to Accounting → Reports

- Click on GST Report

- Select your desired date range

- Choose GST type filter (if applicable)

- Click Generate Report

Report Filters

Date Range Selection

- From Date: Starting date for the GST analysis

- To Date: Ending date for the GST analysis

- Default Range: Current financial year

GST Type Filter

- All GST: View all GST transactions

- CGST: Central GST only

- SGST: State GST only

- IGST: Integrated GST only

tip

For GST return filing, select the date range matching your filing period (monthly or quarterly).

Report Sections

Summary Cards

Total Taxable Amount

- Sum of all taxable sales before GST

- Excludes tax-exempt and zero-rated supplies

- Base amount for tax calculation

Total CGST

- Central GST collected

- Typically 9% for 18% GST rate

- Payable to Central Government

Total SGST

- State GST collected

- Typically 9% for 18% GST rate

- Payable to State Government

Total IGST

- Integrated GST for inter-state sales

- Full GST rate (e.g., 18%)

- Payable to Central Government

Total GST Collected

- Sum of CGST + SGST + IGST

- Total tax liability for the period

- Amount to be deposited with tax authorities

Detailed Transaction Table

The report includes a detailed table with:

| Column | Description |

|---|---|

| Invoice Number | Unique invoice identifier |

| Invoice Date | Date of invoice generation |

| Customer Name | Name of the customer/buyer |

| GSTIN | Customer's GST Identification Number |

| Taxable Amount | Amount before GST |

| GST Rate | Applicable GST percentage (5%, 12%, 18%, 28%) |

| CGST | Central GST amount |

| SGST | State GST amount |

| IGST | Integrated GST amount |

| Total GST | Total tax on the invoice |

| Invoice Total | Taxable amount + Total GST |

GST Rate Breakdown

The report categorizes transactions by GST rates:

5% GST

- Essential goods and services

- Lower tax bracket items

12% GST

- Standard goods and services

- Mid-tier tax bracket

18% GST

- Most common GST rate

- Standard services and goods

28% GST

- Luxury items and sin goods

- Highest tax bracket

0% GST (Zero-rated)

- Exports

- Certain essential items

Exempt

- Tax-exempt supplies

- No GST applicable

Export Options

Export to Excel

- Download complete GST data in Excel format

- Includes all columns and calculations

- Useful for further analysis and record-keeping

- Compatible with accounting software

Export to CSV

- Download in CSV format

- Import into other systems

- Lightweight file format

Print Report

- Generate printer-friendly version

- Professional formatting

- Include company details and period

- Suitable for physical filing

Use Cases

For Business Owners

- Tax Liability Tracking: Monitor GST payable to authorities

- Cash Flow Planning: Plan for GST payment deadlines

- Compliance Monitoring: Ensure all invoices have correct GST

- Financial Planning: Understand tax impact on revenue

For Accountants

- GST Return Filing: Prepare GSTR-1, GSTR-3B returns

- Reconciliation: Match with GSTR-2A/2B

- Audit Preparation: Maintain detailed GST records

- Tax Planning: Optimize tax liability legally

For Tax Consultants

- Client Advisory: Provide GST compliance guidance

- Return Preparation: Accurate data for filing

- Dispute Resolution: Historical GST data for queries

- Tax Optimization: Identify tax-saving opportunities

GST Compliance Tips

Important

- File Returns on Time: Avoid late fees and penalties

- Verify GSTIN: Ensure customer GSTIN is valid for ITC claims

- Maintain Records: Keep GST reports for at least 6 years

- Reconcile Monthly: Match your records with GSTIN portal

- Reverse Charge: Track reverse charge mechanism transactions separately

Common GST Scenarios

Intra-State Sales (Within Same State)

- CGST + SGST applicable

- Example: 18% GST = 9% CGST + 9% SGST