Editing and Deleting Products

Learn how to update product information and delete products when needed.

✏️ Editing Products

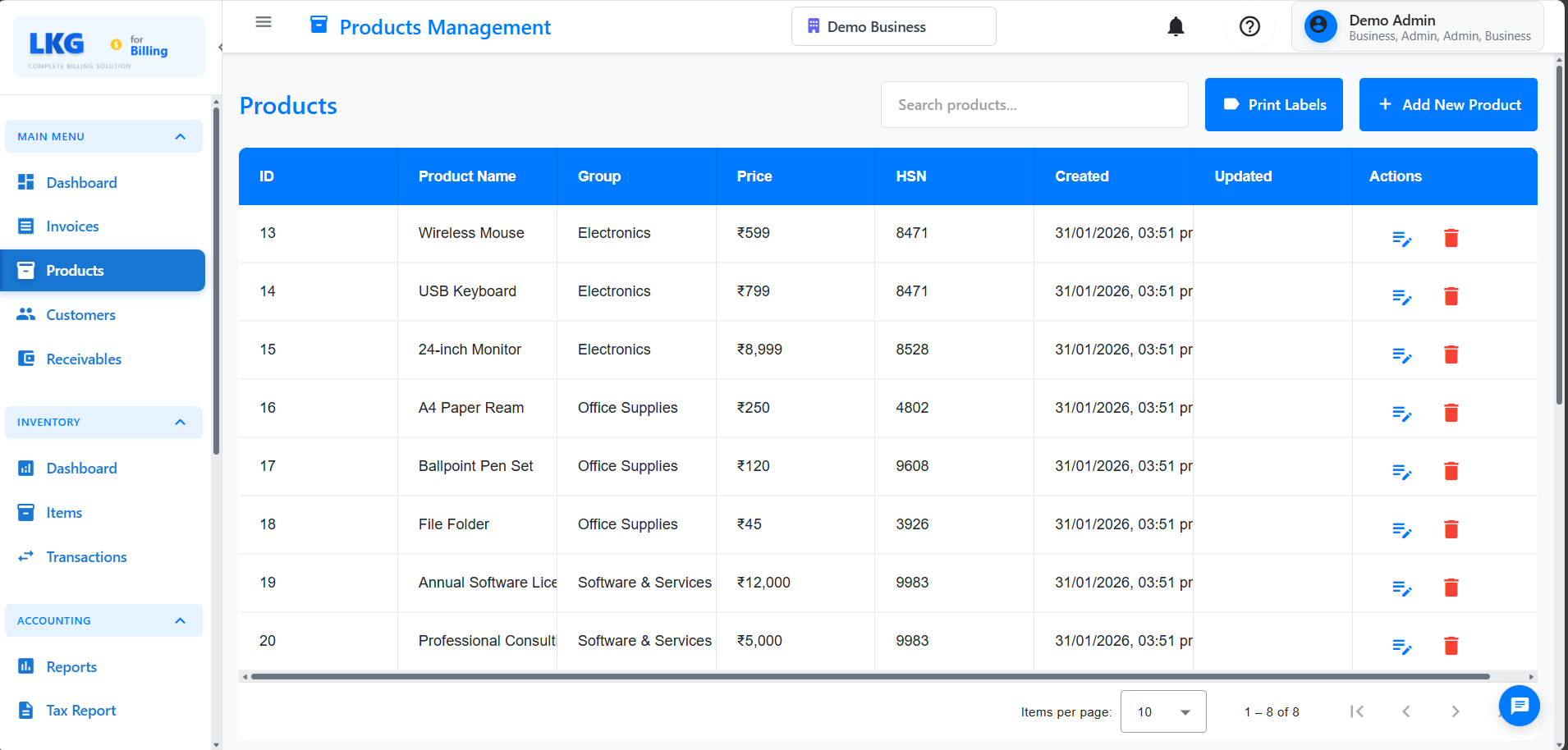

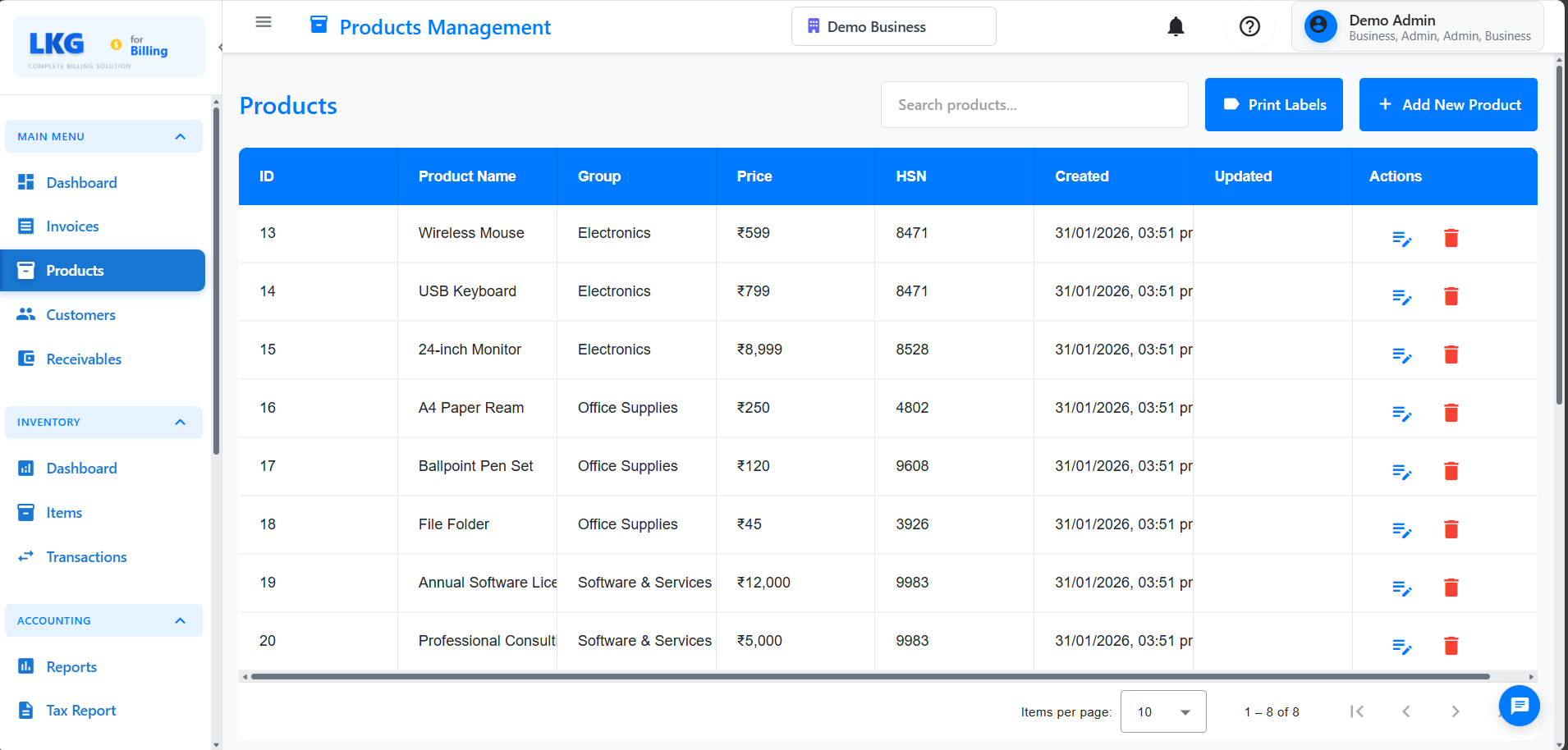

Accessing Product Edit

- Go to Products page

- Find the product in the list

- Click the Edit button (pencil icon)

- Or click Actions (⋮) → Edit

- Product form opens with existing data

Editable Fields

You can edit most product information:

Basic Information:

- Product Name

- Product Code

- Description

- Product Group

- Units

Pricing:

- Base Price

- Tax Rate (GST %)

- Discount %

- Minimum Price

Inventory:

- Track Inventory (Yes/No)

- Current Stock (if tracking enabled)

- Low Stock Alert Level

- Reorder Point

Tax & Compliance:

- HSN Code (manually entered)

- SAC Code (for services)

- Tax Category

- Tax Exemption Status

What You Can Always Edit:

✅ Product name and description

✅ Current stock quantity

What May Be Restricted:

⚠️ HSN code (after used in finalized invoices)

⚠️ Base price (can edit, but doesn't affect existing invoices)

⚠️ Tax rate (new rate applies to future invoices only)

Saving Changes

After editing:

- Review all changes

- Click Save or Update Product

- Product updated across the system

- Existing invoices NOT affected (retain original product data)

- New invoices use updated information

When you edit a product price:

- Existing invoices keep the old price (for audit compliance)

- New invoices use the new price

- Draft invoices may need to be updated manually

🗑️ Deleting Products

When You Can Delete

Products can be deleted under specific conditions:

✅ Can Delete:

- Products never used in invoices

- Products with only draft invoices

❌ Cannot Delete:

- Products in finalized invoices

- Products in paid invoices

- Products with transaction history

- Products referenced in reports

Delete Process

For products with no invoice history:

- Go to Products page

- Find the product to delete

- Click Actions (⋮) → Delete

- Confirm deletion in popup

- Product permanently removed

What Gets Deleted

When you delete a product:

Deleted:

- Product name and description

- Pricing information

- Inventory data (if tracked)

- Draft invoices containing this product (optional)

NOT Deleted:

- Finalized invoices (product info preserved on invoice)

- Paid invoices

- Transaction history (blocks deletion)

- Inventory adjustment history (blocks deletion)

Common Scenarios

Scenario 1: Product Price Changed

Problem: Product price needs to be updated.

Solution:

- Edit the product

- Update the base price

- Save changes

- Note: Existing invoices keep old price

- New invoices use new price

- Update draft invoices manually if needed

Scenario 2: Wrong HSN Code

Problem: HSN code entered incorrectly on product.

Solution:

- Check if product used in finalized invoices

- If NO invoices: Edit and correct HSN code

- If finalized invoices exist:

- Correcting HSN may affect tax compliance

- Add note about HSN correction

- Future invoices use corrected HSN

- Past invoices retain original (for audit)

Product Groups

Impact on Products

When editing/deleting products in a group:

Editing Product Group:

- Can change product's group assignment

- Product moves to new group

- No impact on invoices (retain original group)

Deleting Product Group:

- Cannot delete group with products

- Must remove/reassign products first

- Or mark group as inactive

See Product Groups for details.

HSN Code Management

Editing HSN Codes

HSN codes must be entered manually:

- Edit the product

- Find HSN Code field

- Enter the HSN code (4, 6, or 8 digits)

- System validates format

- Save product

Important:

- No HSN code search/filter available

- Must know correct HSN code

- Refer to GST HSN code list

- Verify code is correct before saving

After Invoices Created:

- Can edit HSN code, but affects only future invoices

- Past invoices retain original HSN (for audit compliance)

- Consider implications before changing

Data Integrity

Related Records Impact

Before deleting a product, check:

Invoices:

- Draft invoices (will be affected)

- Finalized invoices (prevent deletion)

- Paid invoices (prevent deletion)

Inventory:

- Stock adjustments (prevent deletion)

- Stock movement history

- Current stock levels

Reports:

- Product appears in sales reports

- Tax reports reference product

- Deletion creates data gaps

Product Groups:

- Product may be last in group

- Consider group cleanup too

Audit Trail

Product edits and deletions are logged:

Log Entry Includes:

- Who made the change (user name)

- When changed (date and time)

- What changed (field names and values)

- Product details (name, code, ID)

Example:

Product Updated

Date: Nov 20, 2024 3:30 PM

User: Admin User

Product: Wireless Mouse (SKU: WM-001)

Changes:

- Price: ₹500 → ₹450

- HSN Code: 8471 → 84713000

Best Practices

Before Editing

- Verify product - Ensure editing the right record

- Check invoice usage - See where product is used

- Document changes - Note significant changes (esp. price, tax)

- Plan impact - Consider effect on drafts and future invoices

Before Deleting

- Verify no invoices - Check product has no transaction history

- Check inventory - Ensure no stock adjustments exist

- Export data - Save product info if needed

Permissions

Who Can Edit/Delete

Admin Users:

- Edit all products

- Delete products (if eligible)

- Override some restrictions (limited)

Regular Users:

- Edit products they created

- Cannot delete products with invoices

Inventory Users:

- Edit stock quantities

- View product details

- Cannot change pricing or tax

Read-Only Users:

- Cannot edit products

- Cannot delete products

- View-only access

Troubleshooting

Cannot Edit Product

Problem: Edit button is grayed out.

Solutions:

- Check you have edit permissions

- Verify product is not locked by another user

- Refresh the page

- Contact administrator

Changes Not Saving

Problem: Product edits not saving.

Solutions:

- Check for validation errors (red highlights)

- Ensure required fields filled

- Verify price is a valid number

- Check HSN code format

- Ensure product code/Id is unique

Cannot Delete Product

Problem: Delete option not available or fails.

Reasons:

- Product used in finalized/paid invoices

- Product has inventory adjustment history

- Product referenced in reports

- Insufficient permissions

Solution: Mark product as Inactive instead.

HSN Code Not Saving

Problem: HSN code field shows error.

Solutions:

- HSN code must be 4, 6, or 8 digits

- No spaces or special characters

- Check if HSN code is valid per GST rules

- Enter manually (no search available)

Next Steps

- Product Overview - Understanding product management

- Create Product - Adding new products

- Product Groups - Organizing products

- Inventory Management - Managing stock

Important: Always use "Inactive" status instead of deletion for products with transaction history. This maintains data integrity and compliance with tax/accounting standards.