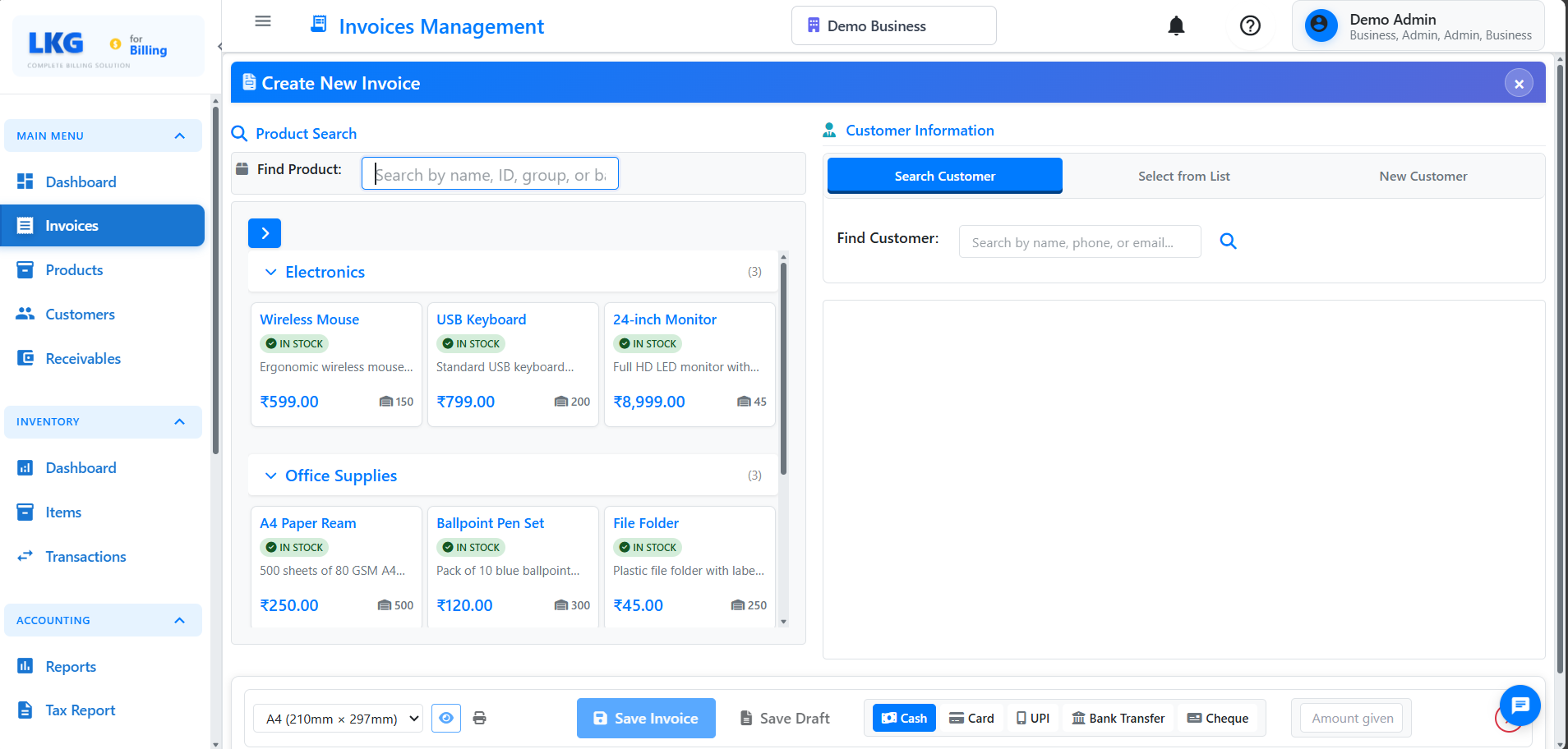

Creating an Invoice

Learn how to create professional invoices for your customers.

📋 Invoice Creation Workflow

Creating an invoice involves selecting a customer, adding products/services, and setting payment terms.

Step 1: Navigate to Invoices

From the dashboard or main menu, click on Invoices.

Step 2: Click "Create Invoice"

Look for the "New Invoice" or "Create" button (usually with a ➕ icon).

📝 Invoice Header Information

Customer Selection

Step 1: Click the Customer dropdown or search field

Step 2: Search for the customer by name or email

Step 3: Select the customer from the list

If the customer doesn't exist, click "Add New Customer" directly from the invoice form.

Sample Customer: John Doe or Acme Corporation

Invoice Number

The invoice number is typically auto-generated:

Format Examples:

INV-2024-001BILL-2024-11-0012024-001

The system automatically assigns the next sequential number. You can customize the format in Settings.

Invoice Date

The date when the invoice is issued.

Default: Today's date

Format: November 20, 2024 or 20/11/2024

Due Date

The payment deadline for the invoice.

Common Options:

- Net 15: 15 days from invoice date

- Net 30: 30 days from invoice date

- Net 45: 45 days from invoice date

- Due on Receipt: Immediate payment

- Custom Date: Specific date

Sample Due Date: 30 days from today = December 20, 2024

Reference / PO Number (Optional)

Customer's purchase order or reference number.

Examples:

PO-2024-12345REF-CONSULTING-NOVProject-Website-Redesign

📦 Adding Line Items

This is where you add products/services to the invoice.

Step 1: Click "Add Item" or "Add Line"

Step 2: Select Product/Service

Option A: Select Existing Product

- Click the product dropdown

- Search or scroll to find the product

- Click to select

Option B: Add Custom Item

- Click "Custom Item" or "New Item"

- Enter item details manually

Step 3: Enter Item Details

Description

What you're charging for.

Examples:

Professional IT Consulting - November 2024

Website Design and Development

Monthly Software License

Quantity

How many units.

Unit Price

Price per unit.

Tax Rate (Optional)

Applicable tax percentage.

Examples:

18- 18% GST12- 12% GST0- No tax

Line Total

Automatically calculated: Quantity × Unit Price + Tax

Example Calculation:

Quantity: 10

Unit Price: ₹1,500

Subtotal: ₹15,000

Tax (18%): ₹2,700

Line Total: ₹17,700

Step 4: Add More Items

Click "Add Another Item" to add multiple products/services.

Sample Multi-Item Invoice:

Item 1: Website Design Package

Quantity: 1

Price: ₹25,000

Tax: 18%

Total: ₹29,500

Item 2: Annual Hosting

Quantity: 1

Price: ₹5,000

Tax: 18%

Total: ₹5,900

Item 3: Domain Registration

Quantity: 1

Price: ₹1,000

Tax: 18%

Total: ₹1,180

💰 Invoice Totals

The system automatically calculates:

Subtotal

Sum of all line items before tax.

Example: ₹31,000

Tax Amount

Total tax across all items.

Example: ₹5,580 (18% of ₹31,000)

Discount (Optional)

Apply a discount to the invoice.

Discount Types:

- Percentage:

10%off total - Fixed Amount:

₹2,000off

Example:

Subtotal: ₹31,000

Discount (10%): -₹3,100

After Discount: ₹27,900

Tax (18%): ₹5,022

Total: ₹32,922

Grand Total

Final amount due.

Example: ₹36,580

✅ Saving the Invoice

You have several options when saving:

Save as Draft

- Invoice is saved but not sent

- You can edit it later

- Not visible to customer

- Use when: Invoice needs review or approval

Button: Click "Save as Draft"

Save and Print

- Invoice is saved

- Print dialog opens

- You can print physical copy

- Use when: Customer needs paper invoice

Button: Click "Save and Print"

💡 Sample Complete Invoice

Here's a full example:

INVOICE: INV-2024-001

Date: November 20, 2024

Due Date: December 20, 2024

BILL TO:

John Doe

Acme Corporation

john@acmecorp.com

+91-98765-43210

ITEMS:

1. Professional Consulting - November 2024

10 hours × ₹1,500 = ₹15,000

Tax (18%): ₹2,700

Total: ₹17,700

2. Website Design Package

1 × ₹25,000 = ₹25,000

Tax (18%): ₹4,500

Total: ₹29,500

Subtotal: ₹40,000

Tax Total: ₹7,200

Grand Total: ₹47,200

Payment Terms: Net 30 Days

❌ Common Errors

No Customer Selected

Error: "Please select a customer"

Solution: Choose a customer from the dropdown

No Items Added

Error: "Invoice must have at least one item"

Solution: Add at least one product or service

Invalid Quantity/Price

Error: "Quantity and price must be positive numbers"

Solution: Enter valid positive numbers

Past Due Date

Warning: "Due date is before invoice date"

Solution: Set due date after invoice date

🎯 After Creating Invoice

Once created, you can:

- Record a Payment - Log payment received

- Send Reminder - Email customer about pending payment

- Download PDF - Get printable copy

- Duplicate - Create similar invoice quickly

- Delete Draft - Remove draft invoices created by mistake

💡 Best Practices

- Detailed Descriptions - Be clear about what's being charged

- Accurate Quantities - Double-check the units

- Proper Tax Rates - Ensure correct tax percentages

- Clear Payment Terms - Specify when payment is due

- Professional Appearance - Review before sending

- Prompt Sending - Send immediately after work completion

- Follow Up - Send reminders for overdue invoices

🔄 Quick Invoice Creation Tips

For Standard Packages

- Create products for packages

- Select from dropdown

- No manual entry needed

For Multiple Clients

- Set up all products first

- Add all customers

- Create invoices quickly by selecting

Invoice created? Learn how to record payments next! 👉